Have Enough To Retire, Invest Your Money

Updated: Oct 26, 2021 at 3:46PM

How much money do you need to comfortably retire? $1 million? $2 million? More?

The most common rule of thumb is that the average person will need approximately 80% of their pre-retirement income to sustain the same lifestyle after they retire. However, there are several factors to consider, and not all of this income will need to come from your savings. With that in mind, here's a guide to help calculate how much money you will need to retire.

It's not about money, it's about income

One important point when it comes to determining your retirement "number" is that it isn't about deciding on a certain amount of savings. For example, the most common retirement goal among Americans is a $1 million nest egg. But this is faulty logic.

Image source: Getty Images.

The most important factor in determining how much you need to retire is whether you'll have enough money to create the income you need to support your desired quality of life after you retire. Will a $1 million savings balance allow you to create enough income forever? Maybe, but maybe not. That's what we're going to determine in the next few sections.

So how much income do you need?

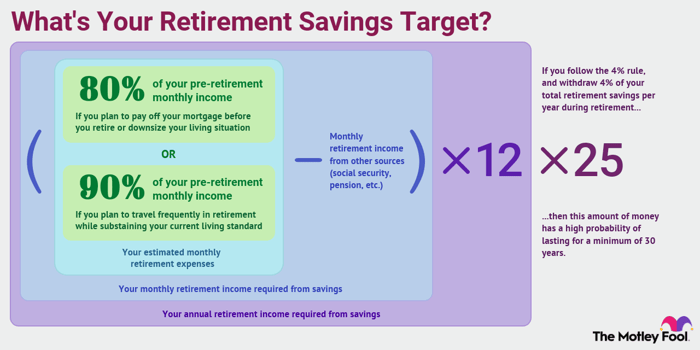

With that in mind, you should expect to need about 80% of your pre-retirement income to cover your cost of living in retirement. In other words, if you make $100,000 now, you'll need about $80,000 per year (in today's dollars) after you retire, according to this principle.

The idea is that once you retire, you'll be able to eliminate certain expenses. You'll no longer have to save for retirement (obviously), and you might spend less on commuting expenses and other costs related to going to work.

Now, this retirement withdrawal strategy isn't perfect for everyone, and you might want to adjust it up or down based on the type of retirement you plan to have and if your expenses will be significantly different.

For example, if you plan to travel frequently in retirement, you may want to aim for 90% to 100% of your pre-retirement income. On the other hand, if you plan to pay off your mortgage before you retire or downsize your living situation, you may be able to live comfortably on less than 80%.

Let's say you consider yourself the typical retiree. Between you and your spouse, you currently have an annual income of $120,000. Based on the 80% principle, you can expect to need about $96,000 in annual income after you retire, which is $8,000 per month.

Social Security, pensions, and other reliable income sources

The good news is that, if you're like most people, you'll get some help from sources other than your savings. For example, Social Security replaces about 40% of the average American's pre-retirement income all by itself. The percentage is typically lower than this for higher-income retirees, but, for most people, Social Security is a significant income source.

If you aren't sure how much you can expect, check your latest Social Security statement, or create a my Social Security account to get a good estimate based on your work history.

If you have any pensions from current or former jobs, be sure to take those into consideration in this step. The same goes for any other predictable and permanent sources of income -- for example, if you bought an annuity that kicks in after you retire.

Continuing our example of a couple that needs $8,000 in monthly income to retire, let's say each spouse is expecting $1,500 per month from Social Security and that one spouse also has a $1,000 monthly pension. This means that, of the $8,000 in monthly income needs, $4,000 is being taken care of by sources other than savings.

So, in summary, you can estimate the monthly retirement income you need to generate using this formula:

Monthly income required = Estimated monthly retirement expenses-Monthly retirement income from other sources

How much savings will you need to retire?

Now let's determine how much savings you'll need to retire. After you've figured out how much income you'll need to generate from your savings, the next step is to calculate how large your retirement nest egg needs to be in order to be able to produce this much income in perpetuity.

A retirement calculator is one option, or you can use the "4% rule." While the 4% rule admittedly has its flaws, it's a good starting point for determining a safe annual withdrawal amount.

The 4% rule says that, in your first year of retirement, you can withdraw 4% of your retirement savings. So, if you have $1 million saved, you would take $40,000 out during your first retired year either in a lump sum or as a series of payments. In subsequent years of retirement, you would adjust this amount upward to keep up with cost-of-living increases.

The most important consideration in deciding how much you need to retire is whether you'll have enough money to create the income you need to support your desired quality of life after you retire.

The idea is that, if you follow this rule, you shouldn't have to worry about running out of money in retirement. Specifically, the 4% rule is designed to make sure your money has a high probability of lasting for a minimum of 30 years.

To calculate a retirement savings target based on the 4% rule, you use the following formula:

Retirement savings target = Annual income required x 25

Continuing our example, we saw in the previous section that our couple would need $4,000 per month ($48,000 per year) from their savings. So, in this case, our couple should aim for $1.2 million in retirement savings to provide $48,000 per year in sustainable retirement income.

The bottom line on retirement savings goals

There is no perfect method of calculating your retirement savings target. Investment performance will vary over time, and it can be difficult to accurately project your actual income needs.

Furthermore, it's worth mentioning other considerations. For one thing, not all retirement plans are equal when it comes to income. Money you withdraw from a traditional IRA or 401(k) will be considered taxable income. On the other hand, any money you withdraw from a Roth IRA or Roth 401(k) is generally not taxable at all, which may change the calculation a bit.

That's just one example, and there are other possible considerations as well. While we're trying to present the broad strokes here, it's still a good idea to consult a financial advisor who can not only tailor a retirement savings goal to your particular situation but can also help set you on the right path with a savings and investment plan that can make sure you reach your goals.

By using the methods discussed in this article, you can get a good idea of how much you'll need to save in order to retire comfortably. Keep in mind this isn't designed to be a perfect method but a starting point to help you assess where you are and what adjustments you might need to make to get yourself to where you need to be.

Expert Q&A

The Motley Fool caught up with retirement expert David John, a senior strategic policy advisor at the AARP Public Policy Institute.

David C. John, MA, MBA, AARP Senior Policy Advisor. David's areas of focus are retirement savings, pensions, annuities, international pension and retirement savings systems, and PBGC.

The Motley Fool: Because of the COVID-19 pandemic, many Americans now fear they won't be able to retire. What is your advice for someone who may be worried about retiring because of recent financial setbacks?

David John: If your health, family responsibilities and job status allows, continue to work longer than you might have before. The extra time allows you to save more and for the markets to continue to recover from past losses. Most important, delay taking your Social Security for as long as possible so you'll have a larger, inflation-protected benefit.

The Motley Fool: There are no hard and fast rules about when to retire or how much we should have saved, but what three pieces of advice would you give someone who is just starting their first retirement savings account?

David John:

- Make saving a priority and contribute a consistent percentage of your income that grows over time every pay day.

- Invest only in a diversified option like a target date fund that uses passive index funds. Don't try to beat the market with your retirement money.

- Don't take a withdrawal unless you absolutely have to. Instead, start a separate emergency fund in addition to your retirement account.

Have Enough To Retire, Invest Your Money

Source: https://www.fool.com/retirement/how-much-do-i-need/

Posted by: camaraopery1965.blogspot.com

0 Response to "Have Enough To Retire, Invest Your Money"

Post a Comment